09 April 2020 - GAP Accountants

ATO on property investments

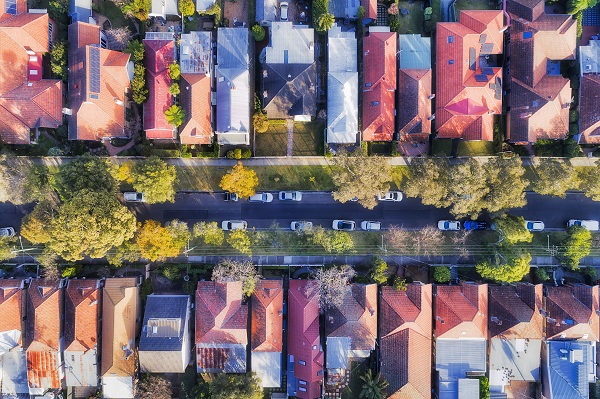

The ATO has reminded taxpayers in a property business or thinking about investing in property that there are things they should know, such as.

- they need a clearance certificate from the supplier when buying property over $750,000;

- they may have to pay the GST on the sale of brand new residential property separately to the ATO; and

- income from property activities could increase their total business turnover.

The ATO says tax time can be made easier by keeping accurate and complete records for the period the taxpayer owns the property and they are:

- renting it out as a residential property (even short-term through the sharing economy);

- flipping houses; and/or

- building a new house to sell for a profit.

In addition, when it’s time to lodge, taxpayers should remember:

- Some expenses need to be claimed over time.

- It is only possible to claim expenses for:

- periods when the property is genuinely available for rent; and

- travel related to renting property, if the taxpayer is in the business of letting properties.

Latest News

14 April 2023 - GAP Accountants

13 April 2023 - GAP Accountants

12 April 2023 - GAP Accountants

11 April 2023 - GAP Accountants

06 April 2023 - GAP Accountants

07 March 2023 - GAP Accountants

06 March 2023 - GAP Accountants

03 March 2023 - GAP Accountants

Categories

- Accounting (20)

- ASIC (2)

- ATO update (291)

- ABN (2)

- ATO audits (23)

- ATO scam alert (12)

- Budget updates (13)

- Communication (8)

- Court rulings (9)

- Data-matching (24)

- Technology (9)

- Business (107)

- Benchmarking (5)

- Employing (32)

- Small businesses (44)

- Corporate (19)

- Division 7A (7)

- COVID-19 (42)

- Disaster Relief (6)

- Federal Election (1)

- Finance (15)

- Cryptocurrency (6)

- Foreign/off-shore issues (15)

- GAP Office Update (1)

- Industry (25)

- Construction (7)

- Contractors (3)

- Courier/driving (6)

- Farming (2)

- Gig Economy (1)

- Medical (2)

- Retail (4)

- Sharing economy (7)

- JobKeeper (23)

- LCT (1)

- Single Touch Payroll (12)

- Superannuation (88)

- Division 293 (2)

- LRBA (6)

- Self-managed super funds (17)

- Superannuation contributions (36)

- TBC (Transfer Balance Cap) (1)

- Superannuation Guarantee (7)

- Taxation (208)

- CGT (8)

- Deductions (42)

- Depreciation (11)

- FBT (26)

- GST (29)

- HELP/VSL/TSL debt (2)

- LCT (1)

- PAYG (11)

- Private Health Insurance (1)

- Properties (3)

- Rental property (18)

- Tax debt (4)

- Tax Records (3)

- Uncategorised (8)