GAP Accountants News

Stay in touch and up-to-date

Category: Taxation

The AAT has held that a partnership’s entitlement to $16,361 of input tax credits claimed for the quarterly …

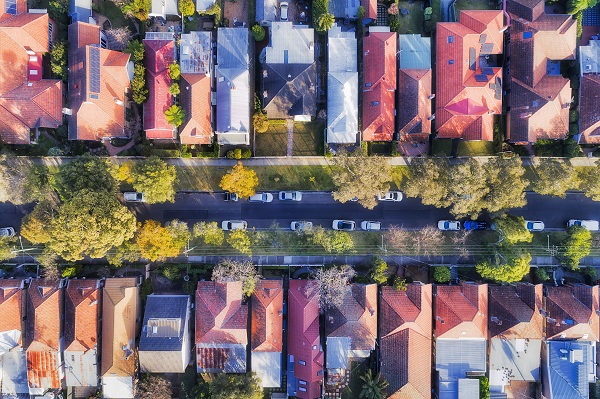

The ATO is reminding taxpayers that have a residential rental property, to take care when making claims for …

When a trustee of a trust makes a decision to create an entitlement to income of the trust …

The ATO is focusing on four major concerns this tax season when it comes to rental properties.

Concern 1: …

The ATO has updated the cents per kilometre rate relating to individual car expenses for the 2023 income …

Taxpayers are being warned to be on the lookout for dodgy online ads, often on social media platforms, …

Taxpayers are reminded not to make the mistake of ‘double dipping’ on deductions (that is, claiming expenses twice) …

The ATO has announced four key areas that it will be focusing on for Tax Time 2022:

Record-keeping.

Work-related expenses.

Rental …

The ATO is in the process of writing to taxpayers that may be eligible to have their tax …

An event that we have become accustomed to every 1 April, is that the amount of the Private …

Categories

- Accounting (20)

- ASIC (2)

- ATO update (291)

- ABN (2)

- ATO audits (23)

- ATO scam alert (12)

- Budget updates (13)

- Communication (8)

- Court rulings (9)

- Data-matching (24)

- Technology (9)

- Business (107)

- Benchmarking (5)

- Employing (32)

- Small businesses (44)

- Corporate (19)

- Division 7A (7)

- COVID-19 (42)

- Disaster Relief (6)

- Federal Election (1)

- Finance (15)

- Cryptocurrency (6)

- Foreign/off-shore issues (15)

- GAP Office Update (1)

- Industry (25)

- Construction (7)

- Contractors (3)

- Courier/driving (6)

- Farming (2)

- Gig Economy (1)

- Medical (2)

- Retail (4)

- Sharing economy (7)

- JobKeeper (23)

- LCT (1)

- Single Touch Payroll (12)

- Superannuation (88)

- Division 293 (2)

- LRBA (6)

- Self-managed super funds (17)

- Superannuation contributions (36)

- TBC (Transfer Balance Cap) (1)

- Superannuation Guarantee (7)

- Taxation (208)

- CGT (8)

- Deductions (42)

- Depreciation (11)

- FBT (26)

- GST (29)

- HELP/VSL/TSL debt (2)

- LCT (1)

- PAYG (11)

- Private Health Insurance (1)

- Properties (3)

- Rental property (18)

- Tax debt (4)

- Tax Records (3)

- Uncategorised (8)